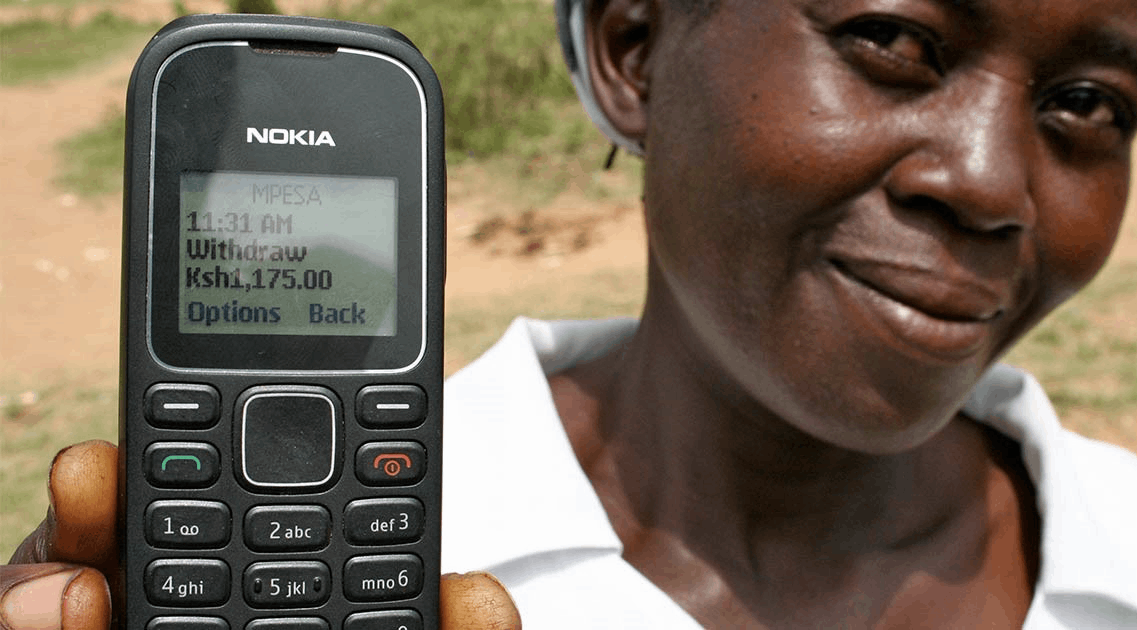

ICT for financial access: Mobile money and the financial behavior of rural households in Uganda

By Tomoya Matsumoto (PhD)

Mobile money usage has expanded tremendously in Uganda, reaching over 40% of the adult population within 8 years of inception. We use data from 820 rural households to examine the effect of this financial innovation on their financial behavior. We find that using mobile money services increases the likelihood of saving, borrowing, and receiving remittances.

Immigrants’ contribution to public finance in Rwanda, Chapter 6 in an OECD book on How Immigrants Contribute to Rwanda’s Economy

by Ggombe Kasim Munyegera (PhD)

Most investigative efforts on migration have focused on developed countries while less is known about the economic value of immigrants in developing countries as countries of destination. This chapter investigates the role played by the immigrant population in Rwanda’s fiscal balance in 2012.

Measuring the impact of unconditional cash transfers on consumption and poverty in Rwanda

by Dominique Habimana, Jonathan Haughton, Joseph Nkurunziza, Dominique Marie-AnnickHaughton;

Mobile Money, Remittances, and Household Welfare: Panel Evidence from Rural Uganda

Author: Tomoya Matsumoto (PhD)

Access to financial services is crucial for development as it enhances resource mobilization needed for productive investment and facilitates consumption smoothing. With a vast majority of adult Ugandans having no access to formal financial services, mobile money is expected to bridge this gap especially in rural areas.

Remittance Inflows and Economic Development in Rwanda

By Dr. Edward Kadozi

This thesis examines the effects of remittances on economic development and the intermediate role of institutional and development factors. It examines the development impact of remittances in Sub-Saharan African (SSA) countries for the period between 1980 and 2014, with a particular focus on Rwanda. The findings find no significant effect of remittances on economic growth in the SSA region. This seems to imply that the remittance-growth effect plays out differently within the region. Similar findings reveal that on average, the remittance-growth impact is positively and significantly influenced by a country’s level of development, financial development and education.

Remittance inflows and economic growth in Rwanda

By: Edward Kadozi, PhD

This paper examines the impact of remittance inflows on economic growth in Sub-Saharan Africa (SSA) countries and Rwanda in particular for the period between1980 and2014. It explores whether the growth impact of remittances is conditional on the institutional and development factors in SSA countries. The analytical framework of this study is embedded in the debate between two dominant theoretical approaches about the growth effect of remittances; the national accounts and endogenous growth models.